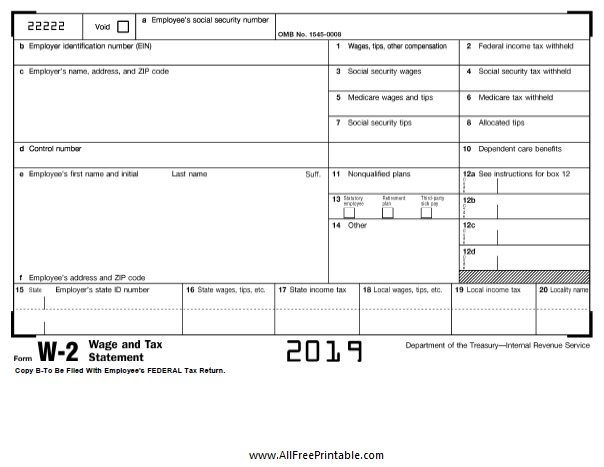

There are fields that provide the employer's information, including the company's Employer Identification Number (EIN) (federal) and the employer's state ID number. W-2 forms are divided into state and federal sections since employees must file taxes on both levels. For example, if you receive a W-2 Form in January 2020 it reflects your income for 2019.Įvery W-2 has the same fields, no matter the employer. Tax documents are filed for the previous year. The SSA uses the information on these forms to calculate the Social Security benefits to which each worker is entitled. By the end of January, employers must file, for the previous year, Form W-2, along with Form W-3, for each employee with the Social Security Administration (SSA). 31 each year, so the employee has ample time to file his or her income taxes before the deadline (which is April 15 in most years).Įmployers must also use W-2 forms to report Federal Insurance Contributions Act (FICA) taxes for their employees throughout the year. The employer must send the employee the W-2 form on or before Jan.

This does not include contracted or self-employed workers, who must file taxes with different forms. An employer is legally required to send out a W-2 form to every employee to whom they paid a salary, wage, or another form of compensation.

0 kommentar(er)

0 kommentar(er)